Table of Contents

- Retirees Struggle with New Social Security 2025 COLA Forecast at a ...

- How Big Will The Raise Be For Social Security In 2025?

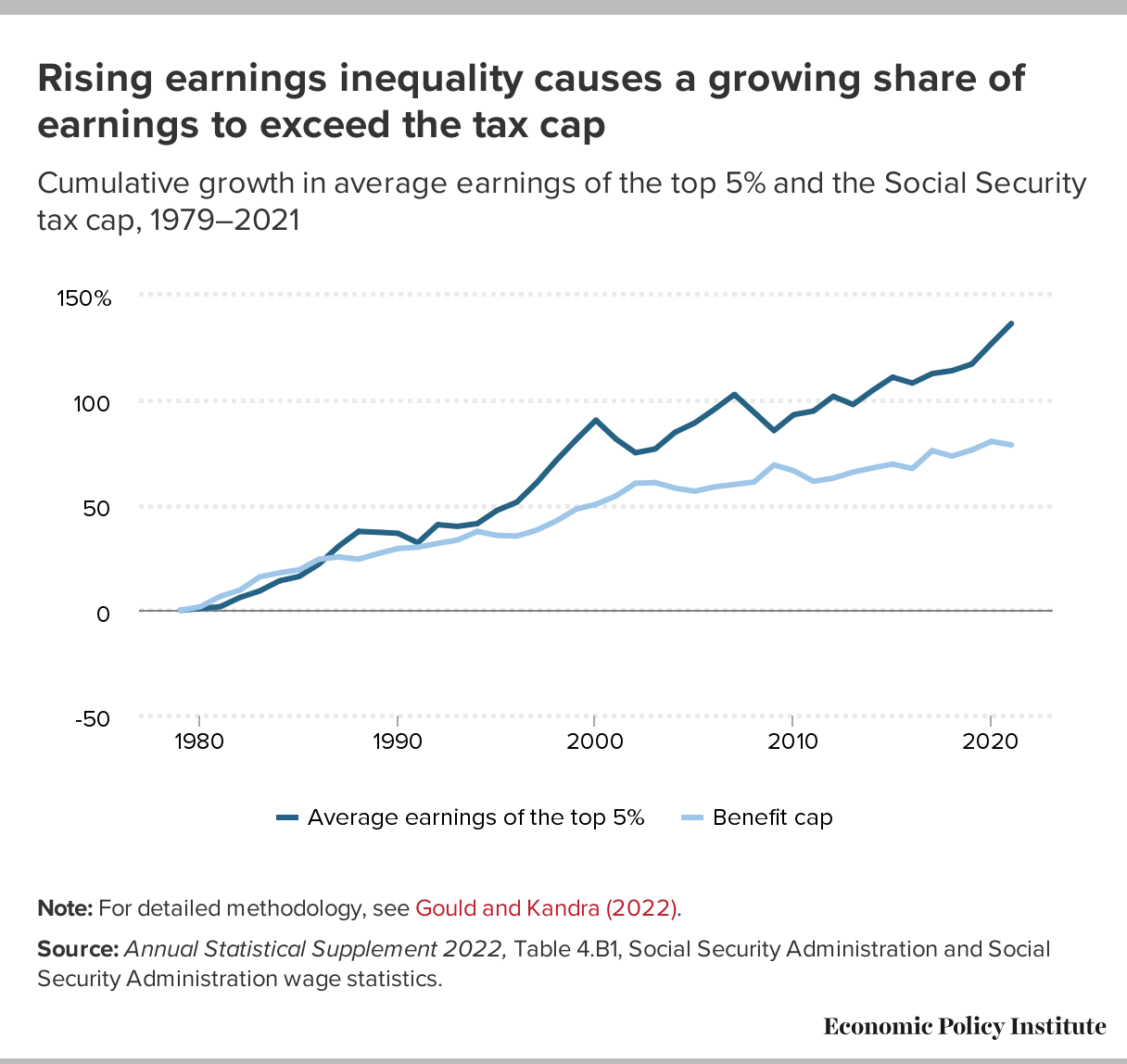

- A record share of earnings was not subject to Social Security taxes in ...

- Social Security Just Released the 2025 COLA. Here's What It Means for ...

- 2025’s Tax Sunset and DC Plans | PLANADVISER

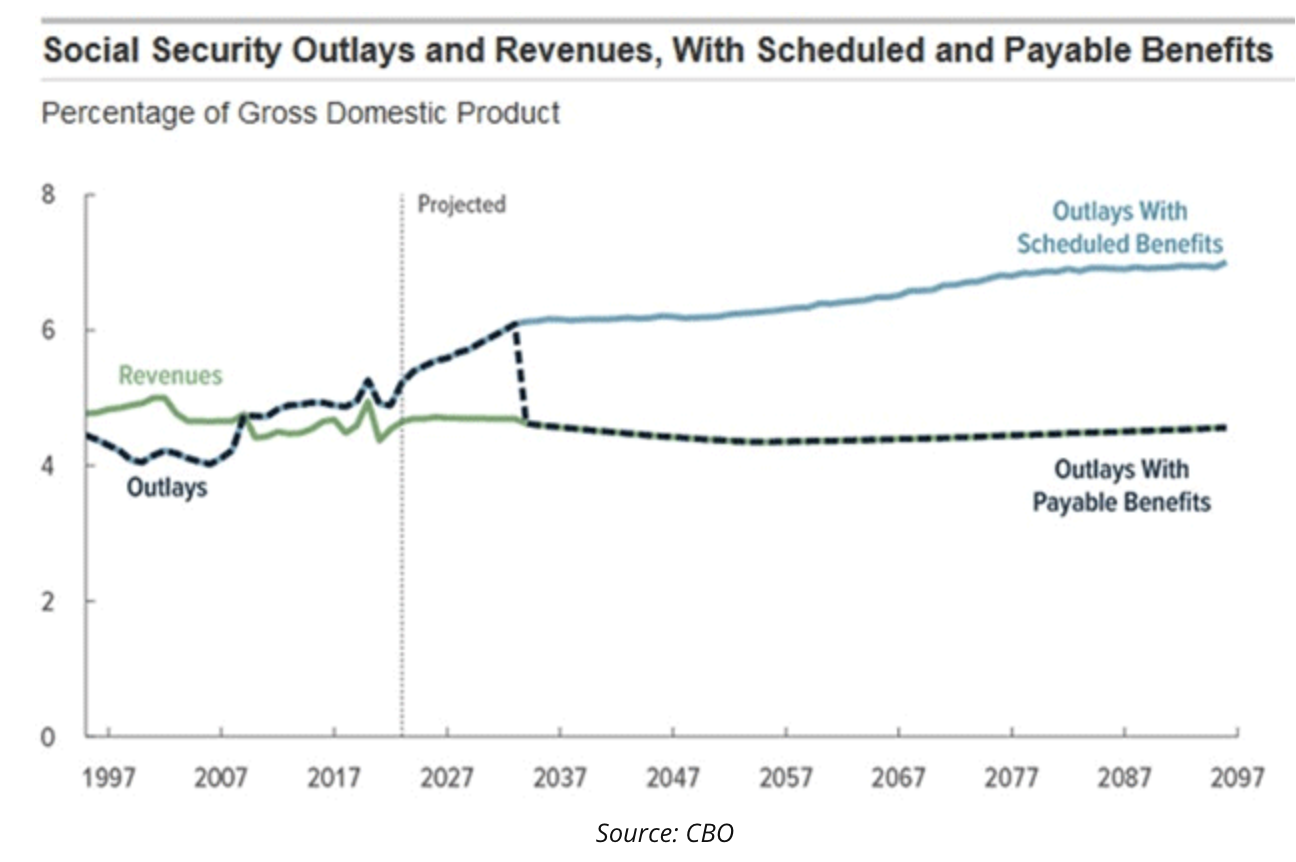

- Social Security Remains Unsustainable

- Trump or Biden's 3 SURPRISING Changes For Social Security in 2025 SSA ...

- 2025 Social Security Increase - YouTube

- Social Security 2025 COLA Below 20-Year Average — Is It Enough?

- Major Social Security Changes Revealed for 2025 – What Retirees Need to ...

1. Increase in Full Retirement Age

2. Adjustment in Cost-of-Living Allowance (COLA)

3. Changes in Earnings Limits

If you're a working individual who receives Social Security benefits, you should be aware of the earnings limits. The SSA has rules in place that affect how much you can earn while receiving benefits before your payments are reduced or suspended. In April 2025, these earnings limits are set to increase. For beneficiaries who will reach their full retirement age after April 2025, $21,240 is the annual earnings limit ($1,770 per month) before the SSA withholds $1 in benefits for every $2 earned above the limit. For those who will reach their full retirement age in April 2025, the limit is $56,520 per year ($4,710 per month), with $1 in benefits withheld for every $3 earned above this amount.